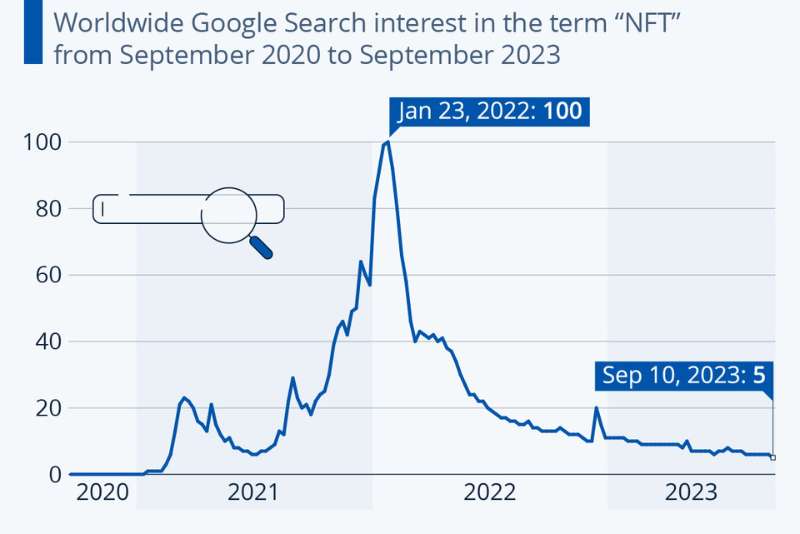

In 2021, the world witnessed a meteoric rise in the Non-Fungible Token (NFT) market, where digital assets were sold for astronomical sums. However, the once-thriving NFT ecosystem now faces questions about its true value. Has the NFT bubble burst? Recent findings from crypto platform dappGambl suggest that the majority of NFTs may have lost their allure.

The NFT Phenomenon and Its Evolution

NFTs, short for non-fungible tokens, are unique blockchain-based digital assets. Each NFT has a distinct identity, making it easily distinguishable from others within the same collection. The blockchain records all NFT transactions, ensuring transparency in ownership.

Initially, NFTs were hailed as a groundbreaking investment opportunity, attracting widespread attention and support from celebrities worldwide. These digital tokens found utility in various forms, from digital art to music, photographs, and even virtual pets.

Minting NFTs and Their Appeal

One of the unique aspects of NFTs is their accessibility; almost anyone with some technical know-how and funds can mint an NFT on platforms like Ethereum and Solana. These tokens grant digital ownership, distinguishing their holders from mere observers.

People buy NFTs for various reasons. Some seek financial gains by waiting for the asset’s value to appreciate before selling, while others acquire them for personal enjoyment or to gain access to exclusive NFT communities. Notable figures, such as actor Amitabh Bachchan, have embraced NFTs to market one-of-a-kind merchandise to their fans.

Additionally, NFT-based online games like Axie Infinity have gained immense popularity, particularly in countries like the Philippines. These “play-to-earn” games enable users to collect digital assets and trade them for real-life profits. However, criticism surrounds the skewed economics of such games.

The Rise and Fall of NFTs

The peak of the NFT craze coincided with a historic year for cryptocurrencies like Bitcoin and Ethereum, both reaching all-time high prices. This surge led to a frenzy of NFT purchases on the Ethereum blockchain in hopes of future price appreciation.

Yet, NFTs have not been without their critics. Financial regulators have cautioned against investing in NFTs due to their unregulated nature and the high volatility of the market. Artists have raised concerns about the prevalence of pirated NFTs on centralized marketplaces, which infringe on their intellectual property rights. Environmentalists also criticize the energy-intensive nature of minting and trading NFTs on blockchains like Ethereum.

Are NFTs Losing Their Luster?

Recent research by dappGambl raises questions about the value of NFTs. The platform examined 195,699 NFT collections, many of which appeared to have no owners or market presence. The energy consumed in minting these NFTs was equated to that of thousands of cars’ annual emissions.

According to dappGambl’s report, the vast majority of NFT collections, specifically 69,795 out of 73,257, had a market cap close to zero. Even some highly popular NFT collections experienced significant value declines. For instance, Bored Ape #3001, once purchased by Justin Bieber for over $1 million, saw its value plummet to around $60,000.

Several real-world factors contributed to this decline, including Russia’s invasion of Ukraine, economic instability, and crypto market fluctuations.

The Impact on the Metaverse

The NFT crash has also had implications for blockchain-based metaverses, where activities and payments rely on cryptocurrencies. In some cases, these crypto tokens lost value. For example, ‘The Sandbox’ metaverse’s SAND token depreciated by nearly 65% over the past year.

Meta’s metaverse, accessed through VR/AR hardware, also felt the effects. Although Meta had introduced options for crypto traders to display their NFTs on Facebook and Instagram, it later decided to “wind down” its involvement with NFTs.

Future Prospects of the NFT Market

The unpredictable nature of the crypto economy makes it challenging to forecast the NFT sector’s recovery. While rising prices of Bitcoin and Ethereum could potentially boost NFTs, these cryptocurrencies themselves are trading far below their 2021 record highs.

In the wake of the FTX exchange collapse, regulatory scrutiny of digital asset sales has intensified. The U.S. Securities and Exchange Commission recently charged the NFT-based web series ‘Stoner Cats’ with conducting an “unregistered offering of crypto asset securities” through NFTs, resulting in an $8 million settlement.

The NFT market’s future remains uncertain, leaving many to wonder whether it will ever recapture its former glory. As the crypto world grapples with ongoing challenges, the fate of NFTs hangs in the balance.

You may also read: Why are there no crypto currency based mobile games?

Gangtokian Web Team, 01/10/23